Struggling with medical billing denials and slow payments? Our ultimate 2025 guide breaks down the billing lifecycle, top challenges, and proven solutions to optimize your healthcare practice’s revenue.

Imagine this: You’ve just wrapped up a busy day seeing patients, only to open your revenue reports and see a pile of denied claims staring back at you. Cash flow slows to a trickle, your team spends hours on appeals, and the stress builds. Sound familiar? You’re not alone—many practice owners and administrators face this exact frustration.

But here’s the good news: Medical billing doesn’t have to be a constant headache. In this ultimate 2025 guide, we’ll simplify the process, walk you through the core steps, uncover the biggest pitfalls, and share practical strategies to get paid faster while slashing denials. With denial rates affecting over 40% of providers (where at least 1 in 10 claims are denied, according to recent industry reports), getting the basics right isn’t just helpful—it’s essential for your practice’s financial health and long-term success.

What is Medical Billing? Beyond Codes and Invoices

At its core, medical billing is the process of translating the care you provide into accurate claims that get paid promptly. It’s about turning healthcare services—like consultations, procedures, and tests—into revenue that keeps your practice running smoothly.

Don’t confuse it with medical coding, though they’re closely related. Coding assigns standardized codes (like CPT and ICD-10) to document what happened during a patient visit. Billing takes those codes and submits them to payers (insurance companies, Medicare, etc.) for reimbursement.

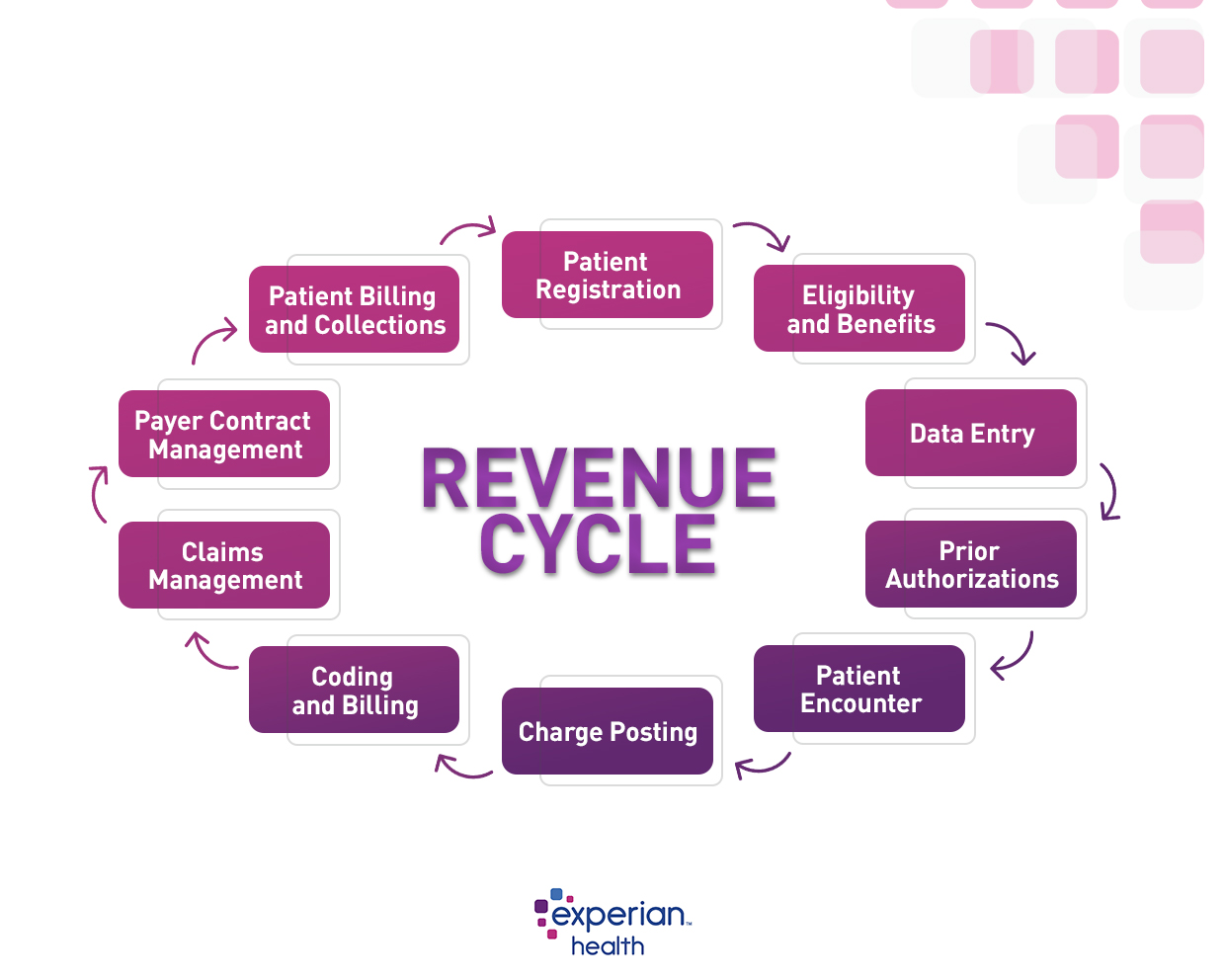

Think of medical billing as the financial backbone of your entire Revenue Cycle Management (RCM) process. It’s the trusty bridge connecting patient care to steady cash flow. For a deeper dive into the full RCM cycle, check out our guide on the RCM cycle in medical billing.

The 8-Step Medical Billing Lifecycle (A Practical Walkthrough)

Medical billing follows a clear sequence—like a well-marked trail through a forest. Getting off track at any point can lead to delays or denials. Here’s the step-by-step breakdown, complete with common pitfalls and pro tips to keep things smooth.

Step 1: Patient Registration & Insurance Verification

Everything starts here. Collect accurate patient info (demographics, insurance details) and verify coverage upfront.

Common Pitfall: Outdated or incorrect insurance info leads to immediate denials. Pro Tip: Automate verification to catch issues early—explore our insurance verification tips for best practices.

Step 2: Encounter & Charge Capture

Document services rendered and capture all billable charges during the patient visit.

Common Pitfall: Missed charges from incomplete documentation. Pro Tip: Use checklists or integrated EHR tools to ensure nothing slips through.

Step 3: Medical Coding & Documentation

Assign accurate codes based on clinical notes.

Common Pitfall: Coding errors or insufficient documentation. Pro Tip: Stay sharp with resources like our modifier cheat sheet or clean claims guide.

Step 4: Claim Submission & Scrubbing

Clean and submit claims electronically to payers.

Common Pitfall: Errors that trigger automatic rejections. Pro Tip: Pre-submission scrubbing catches 90% of issues—more on this in challenges below.

Step 5: Payment Posting & Reconciliation

Post payments received and reconcile with expected amounts.

Common Pitfall: Delays in posting lead to inaccurate AR tracking. Pro Tip: Automate posting for speed and accuracy.

Step 6: Accounts Receivable (AR) Follow-Up

Track unpaid claims and follow up persistently.

Common Pitfall: Aging AR balloons due to lack of follow-up. Pro Tip: Prioritize high-value claims first.

Step 7: Denial Management & Appeals

Analyze denials, correct issues, and appeal when needed.

Common Pitfall: Ignoring root causes leads to repeat denials. Pro Tip: Build a strong appeals process—see our denial fixes for actionable steps.

Step 8: Patient Billing & Collections

Send statements to patients for remaining balances and handle collections.

Common Pitfall: Confusing statements frustrate patients. Pro Tip: Offer clear, multiple payment options.

Top 5 Medical Billing Challenges in 2025 (And How to Overcome Them)

2025 brings evolving hurdles, but they’re manageable with the right approach. Here’s what practices are facing most and smart solutions.

Challenge 1: Rising Claim Denials & Complex Payer Rules

Denial rates are climbing, with many providers seeing 10-15% or higher in 2025.

Solution: Use AI-powered pre-submission scrubbing to catch errors early. Learn more in our explainer on AI denial prediction.

Challenge 2: Keeping Up with Regulatory Changes (No Surprises Act, MIPS, etc.)

Rules shift constantly, risking non-compliance.

Solution: Partner with experts for ongoing compliance tracking. Dive into details in our healthcare compliance regulations category.

Challenge 3: Inefficient Patient Payment Collection

Patients delay or avoid payments due to unclear bills.

Solution: Implement clear financial policies and digital payment options. Templates available in our financial policy templates.

Challenge 4: Staffing Shortages & Training Gaps

Hard to find and retain skilled billers.

Solution: Standardize workflows and invest in training. Front-desk resources at front-desk-billing-training.

Challenge 5: Data Silos Between Clinical & Billing Software

Disconnected systems cause errors.

Solution: Opt for integrated platforms. Tips in our EMR billing tips.

Key Performance Indicators (KPIs): How to Measure Your Billing Health

You can’t fix what you don’t measure. Track these critical KPIs to gauge your billing efficiency:

- Clean Claim Rate (Target: >95-98%): Percentage of claims accepted on first submission. Formula: (Clean Claims Submitted / Total Claims Submitted) × 100. Calculate it with our clean claim rate formula.

- Average Days in Accounts Receivable (AR Days): Aim for under 40 days.

- Net Collection Rate: Should exceed 95%—shows what you’re actually collecting.

- Denial Rate & First-Pass Acceptance Rate: Keep denials below 10%.

- Cost to Collect: Track overhead per dollar collected.

Monitor them easily with a dedicated billing KPI dashboard.

The Future is Here: Technology Transforming Medical Billing

Technology is your ally in 2025, turning complex tasks into streamlined wins.

- Artificial Intelligence (AI): Predictive tools flag potential denials and suggest codes automatically.

- Automation: Handles eligibility checks, payment posting, and more—freeing your team for high-value work.

- Patient Portals: Boost transparency with easy estimates and payments.

Emerging trends like blockchain for secure transactions are gaining traction—read about blockchain in medical billing.

Conclusion: Choosing Your Path Forward

Proactive, accurate medical billing powered by modern technology is the key to financial stability and less stress. By mastering the lifecycle, tackling challenges head-on, and tracking KPIs, you can transform billing from a burden into a reliable revenue engine.

Practices typically choose one of three paths:

- In-House Billing: Gives full control but demands heavy investment in staff, training, and tech.

- Outsourced Billing (The SimplifyingRCM Solution): Expert teams, advanced technology, and scalability let you focus on patients while amplifying revenue.

- Hybrid Model: Combine in-house strengths with outsourced support for specific needs.

Whichever path fits your practice, start by assessing your current process. Ready to simplify? Explore our solutions or download a free billing checklist today.

FAQ: Common Medical Billing Questions

What is medical billing?

Medical billing is the process of submitting and following up on claims with health insurance companies to receive payment for services provided.

How does medical billing differ from medical coding?

Coding assigns standardized codes to services; billing uses those codes to create and submit claims for payment.

What are common reasons for claim denials?

Top causes include coding errors, missing information, lack of prior authorization, and eligibility issues.

How can I reduce my practice’s denial rate?

Focus on upfront verification, accurate coding, claim scrubbing, and root-cause analysis for appeals.

Is outsourcing medical billing worth it?

For many practices, yes—it reduces overhead, improves collections, and leverages expert tech without the full in-house burden.