Introduction No-Surprise Billing Compliance

Imagine walking into an emergency room during a health crisis, only to receive a staggering bill months later from an out-of-network provider you never chose. This scenario haunted millions of Americans before the implementation of key protections, leaving families burdened with unexpected financial strain. Today, healthcare professionals and patients alike navigate a transformed landscape where transparency and fairness take center stage.

The Problem of Surprise Medical Bills: A Common Nightmare

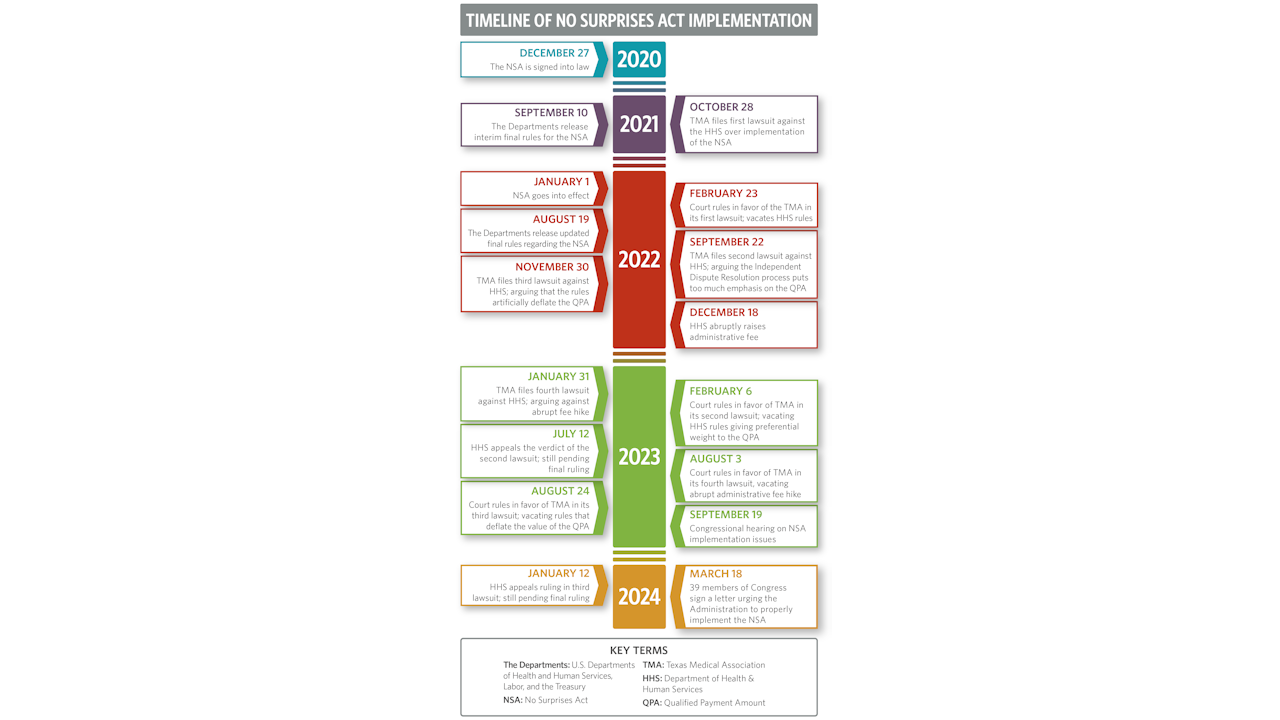

The No Surprises Act, enacted in 2020 and effective from January 1, 2022, revolutionizes how we handle medical billing, ensuring that surprise charges no longer catch people off guard. This legislation empowers you to focus on recovery rather than financial worry, while providers adapt their practices to align with new standards. In this article, we dive deep into no-surprise billing compliance, exploring its intricacies and offering practical insights that demystify the process.

How the No Surprises Act Changed Everything

Whether you’re a healthcare administrator striving to meet regulatory demands or a patient seeking to understand your rights, this guide equips you with the knowledge to thrive in this era of accountable healthcare. We start by examining the core principles, then move through actionable steps, weigh the pros and cons, answer common questions, and wrap up with forward-looking thoughts.

By the end, you’ll grasp how no-surprise billing compliance not only safeguards wallets but also fosters trust in the medical system. Let’s embark on this journey to uncover how these rules reshape interactions between providers, insurers, and those they serve, turning potential pitfalls into opportunities for better care.

Definition and Overview of No-Surprise Billing Compliance

What Is No-Surprise Billing Compliance?

No-surprise billing compliance refers to the adherence to federal regulations designed to protect patients from unanticipated medical expenses arising from out-of-network services. At its heart, this concept stems from the No Surprises Act, a bipartisan law signed in December 2020 as part of the Consolidated Appropriations Act, 2021.

The Act targets three main areas: emergency services, non-emergency care provided by out-of-network professionals at in-network facilities, and air ambulance transports. Providers and insurers actively ensure that patients pay only their standard in-network deductibles, copays, or coinsurance, eliminating the shock of balance bills that previously could exceed tens of thousands of dollars. This compliance framework requires healthcare entities to provide clear disclosures, obtain consents where applicable, and engage in fair dispute resolution processes.

By defining no-surprise billing compliance this way, we see it as more than just a legal obligation it’s a commitment to ethical billing practices that build patient trust and stabilize the healthcare economy.

Historical Context and Key Mechanisms of the No Surprises Act

The overview begins with understanding surprise billing’s history. Before 2022, patients often faced charges from anesthesiologists, radiologists, or pathologists who weren’t part of their insurance network, even if the hospital was. These “surprise” elements arose because patients couldn’t control who treated them during emergencies or procedures.

The No Surprises Act counters this by holding health plans accountable for covering out-of-network costs at in-network rates in protected scenarios. For compliance, providers furnish good faith estimates (GFEs) to uninsured or self-pay patients, detailing expected charges for scheduled services. Insurers, meanwhile, calculate qualifying payment amounts (QPAs) based on median in-network rates to determine fair reimbursements.

Scope, Exceptions, Implementation Challenges, and Ongoing Evolution

To further illustrate, consider the Act’s scope. It applies to most group health plans, individual market coverage, and federal employee health benefits, but excludes certain plans like short-term limited-duration insurance. Providers actively comply by identifying services subject to protections and refraining from direct patient billing until resolutions occur.

This overview underscores the collaborative nature: facilities coordinate with affiliated providers to deliver unified disclosures, ensuring seamless experiences. Challenges in early implementation, such as court rulings vacating parts of initial rules, led to adjustments in IDR methodologies, emphasizing factors beyond just QPAs.

As we delve deeper, remember that no-surprise billing compliance isn’t static; ongoing guidance from CMS, including fact sheets and model forms, helps entities stay aligned. This section provides the foundational knowledge, setting up our exploration of practical steps and beyond.

Step-by-Step Guide to Achieving No-Surprise Billing Compliance

Step 1: Assemble a Cross-Functional Team

Healthcare providers kick off no-surprise billing compliance by assembling a cross-functional team. You gather experts from legal, compliance, billing, finance, operations, IT, and provider networks to assess how the No Surprises Act applies to your organization.

This team reviews current workflows, identifies gaps, and develops policies that integrate the Act’s requirements. For instance, they determine scenarios where surprise billing protections trigger, such as emergency visits or ancillary services at in-network facilities.

Training becomes crucial here you educate frontline staff on recognizing protected services and handling patient inquiries. IT systems get upgraded to flag out-of-network providers and automate disclosures. This initial step lays a robust foundation, ensuring everyone understands their roles in preventing surprise bills and fostering a culture of compliance that minimizes risks and enhances patient satisfaction.

Step 2: Update Billing and Notification Processes

Next, you update billing and notification processes to align with the Act. Providers refrain from sending balance bills directly to patients until confirming whether protections apply. You create identification protocols for services like emergency care or air ambulance transports.

For exceptions, you implement notice and consent procedures, where patients receive detailed information about potential out-of-network costs and voluntarily agree. Disclosures must cover patient rights, including prohibitions on balance billing. Facilities often enter agreements with providers to handle these on their behalf, streamlining operations.

Additionally, you establish mechanisms for good faith estimates: identify uninsured or self-pay patients, notify them of their rights, and generate itemized estimates within specified timelines. This step demands precision inaccurate GFEs can lead to disputes, so you incorporate quality checks and use standardized templates from CMS. By revamping these processes, you not only comply but also improve transparency, reducing patient anxiety and building loyalty.

Step 3: Develop Strategies for Managing Payment Disputes

Then, you develop strategies for managing payment disputes. When insurers offer initial payments, providers evaluate whether to accept them or enter open negotiations. You set criteria based on financial viability, considering administrative costs of escalation. If negotiations fail, you initiate the IDR process, selecting certified entities and submitting offers backed by evidence like service complexity or market rates.

Training your team on IDR timelines such as 30-day negotiation periods ensures timely actions. You track outcomes to refine future approaches, perhaps integrating data analytics to predict fair reimbursements. This strategic layer of no-surprise billing compliance protects revenue streams while upholding fair practices, turning potential conflicts into resolved agreements that benefit all parties.

Step 4: Monitor and Audit Compliance Efforts

Providers continue by monitoring and auditing compliance efforts. You implement regular reviews of billing records, GFEs accuracy, and consent forms to catch inconsistencies early. Compliance officers conduct mock scenarios, simulating emergency cases to test staff responses.

You stay abreast of updates, like fee adjustments for IDR or new guidance on QPA calculations, incorporating them promptly. Collaboration with insurers fosters smoother interactions, perhaps through joint training sessions. This ongoing vigilance in no-surprise billing compliance safeguards against penalties, which can include civil monetary fines up to $10,000 per violation.

Step 5: Engage in Patient Education and Feedback Loops

Finally, you engage in patient education and feedback loops. Providers create resources like brochures or website sections explaining rights under the Act. You solicit patient input post-visit to gauge understanding of estimates and bills. This step closes the compliance cycle, using insights to refine processes and demonstrate commitment to patient-centered care. By following this guide, you achieve comprehensive no-surprise billing compliance, turning regulatory mandates into operational strengths.

Advantages and Disadvantages of No-Surprise Billing Compliance

Advantages

No-surprise billing compliance delivers significant advantages, starting with enhanced patient protection. Patients avoid crippling debts from unexpected charges, allowing them to seek care without fear. This fosters greater utilization of preventive services, improving overall health outcomes. Providers benefit from clearer reimbursement paths via IDR, reducing uncompensated care and stabilizing finances.

Insurers experience fewer disputes, streamlining operations and potentially lowering premiums. Society gains as medical bankruptcies decline, easing economic pressures. Moreover, compliance builds trust— patients view compliant providers favorably, boosting reputations and loyalty. In essence, no-surprise billing compliance creates a fairer system where transparency reigns, encouraging innovation in care delivery models.

Disadvantages

Yet, disadvantages exist, primarily in implementation costs. Providers invest heavily in training, IT upgrades, and administrative staff to handle GFEs and disclosures, straining smaller practices. The IDR process, while fair, incurs fees administrative costs rose to $350 per party in 2024 and time, diverting resources from patient care.

Insurers face challenges calculating QPAs accurately, risking litigation if perceived as unfair. Patients might encounter confusion over exceptions, leading to unintended consents. Overall, while the advantages outweigh, these hurdles highlight the need for supportive resources to ease the transition.

On balance, advantages like financial security and trust far surpass disadvantages, but addressing costs through grants or simplified processes could amplify benefits.

Frequently Asked Questions(FAQs) on No-Surprise Billing Compliance

What exactly does the No Surprises Act protect against?

The No Surprises Act shields patients from balance bills in emergencies, non-emergency out-of-network services at in-network facilities, and air ambulances. Providers and insurers handle disputes behind the scenes, ensuring you pay only in-network amounts. This protection applies to most plans, but check your coverage for specifics.

How do good faith estimates work in no-surprise billing compliance?

For uninsured or self-pay patients, providers deliver GFEs for scheduled services, itemizing costs within 1-3 business days of requests. These estimates help you plan finances, and if actual bills exceed $400 over the estimate, you can dispute via a federal process.

Can providers still balance bill in some cases?

Yes, with notice and consent for non-emergency services, but not for emergencies or certain ancillary providers like anesthesiologists. You receive detailed info 72 hours in advance, allowing informed decisions.

What is the independent dispute resolution process?

When providers and insurers disagree on payments, they enter IDR, submitting offers to certified entities who decide based on factors like service complexity. This resolves issues without involving patients.

How does no-surprise billing compliance affect small healthcare practices?

Small practices may face higher compliance burdens, but resources like CMS templates help. Advantages include fairer reimbursements, though initial setup costs require careful planning.

What should patients do if they receive a surprise bill?

Contact your insurer first to verify coverage, then use the Act’s complaint portals if needed. Keep records and act within timelines to enforce your rights effectively.

Conclusion

In wrapping up, no-surprise billing compliance stands as a pivotal advancement in healthcare, eradicating the dread of unforeseen bills and promoting equity. We’ve covered its definitions, implementation steps, benefits, challenges, and common queries, illustrating how it empowers both providers and patients. As regulations evolve, staying informed ensures continued success. Embrace these changes to cultivate a healthier, more transparent system for all.

Bonus Points: Deeper Insights into No-Surprise Billing Compliance

For those seeking advanced understanding, consider case studies where IDR favored providers, highlighting evidence’s role. Future trends may include AI for GFEs, reducing errors. Explore state laws complementing federal rules for hybrid compliance strategies. This bonus delves into metrics: Track compliance via audit rates and patient satisfaction scores to optimize practices.